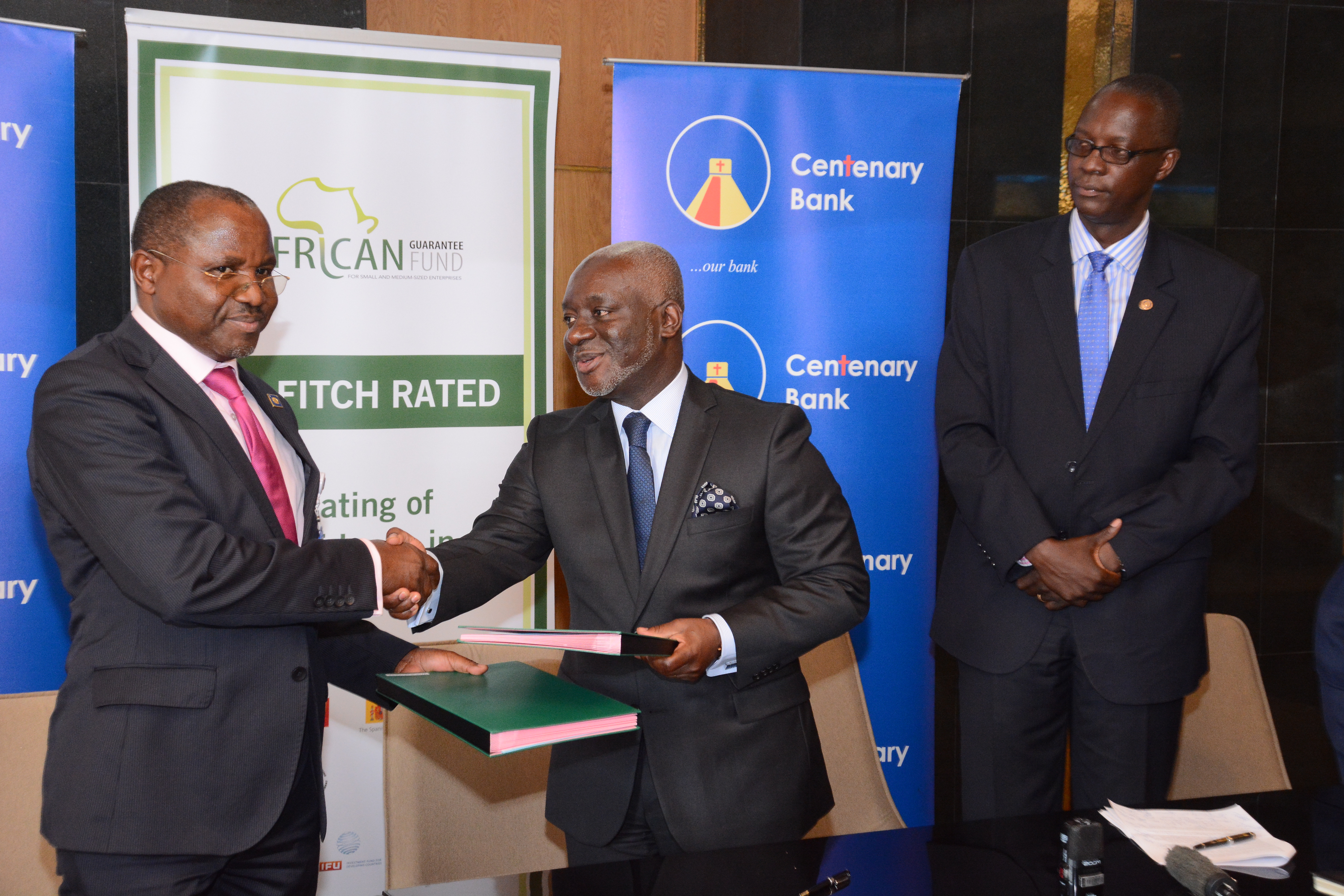

Centenary Bank, Uganda’s largest commercial microfinance bank has today 7th January, 2020 signed a Loan Portfolio Guarantee agreement with the African Guarantee Fund, to fund SMEs in Uganda with credit worth USD 10 Million.

The announcement was made during the signing ceremony between the two organisations that took place at Mapeera House, the Bank’s Head Office in Kampala.

The 5 year partnership aims to unlock financing intended to facilitate the promotion, growth and development of Small and Medium sized Enterprises in Uganda.

Acknowledging the partnership, Mr. Fabian Kasi, the Managing Director, Centenary Bank commended AGF for choosing Our Bank as an implementing partner for the Fund. “Centenary Bank is pleased to collaborate with African Guarantee Fund (AGF) to provide affordable finance to SMEs in Uganda. We believe this partnership will go a long way in improving the private sector and economy in general. SMEs are a key component of our economy and account for over 80% of the private sector.”

Uganda Investments Authority, a statutory agency in charge of initiating and supporting measures that enhance investment in Uganda, defines SMEs as entities that employ between 5 to 100 people, have assets not exceeding UGX 100 million and register revenue not exceeding shs360 million per annum.

Mr. Kasi added that, Centenary Bank is always seeking ideal partners with whom it can better serve its customers with appropriate microfinance solutions in an effort to promote economic growth and development.

“With a vibrant and youthful population, providing funds that aid SMEs to thrive, create more jobs and contribute to the tax base is what our economy needs today,” Mr. Kasi noted.

Last year, Centenary Bank extended a loan portfolio of approximately UGX.160 billion to the SMEs in the economy and we confident that this money is opening new possibilities across the country.

AGF Group Chief Executive Officer, Mr. Felix Bikpo while commenting on the partnership signing said, “Today’s signing ceremony between Uganda’s leading commercial microfinance bank and Africa’s leading financial guarantee provider is phenomenal for Ugandan SMEs. This partnership will boost access to finance for more SMEs which will ultimately lead to job creation and revenue generation. We are very proud to have partnered with a bank that has a vision for SMEs and believes in their potential to spur the growth of Uganda’s economy.”

AGF’s objective is to provide partial credit guarantees and capacity development to financial institutions to stimulate financing of SMEs thereby unlocking their potential to deliver exclusive growth in the continent.

About African Guarantee Fund:

African Guarantee Fund is a non-bank financial institution whose objective is to promote economic development, increase employment and reduce poverty in Africa by providing financial institutions with guarantee products and capacity development assistance specifically intended to support SMEs in Africa.

African Guarantee Fund was founded by the government of Denmark through the Danish International Development Agency (DANIDA), the government of Spain through the Spanish Agency for International Cooperation and Development (AECID) and the African Development Bank (AfDB). Other shareholders include: French Development Agency (AFD), Nordic Development Fund (NDF), Investment Fund for Developing Countries (IFU) and KfW Development Bank (KfW). AGF has a rating of AA- by Fitch Ratings Agency.

About Centenary Bank:

Centenary Bank is the leading commercial microfinance Bank in Uganda, with 74 branches and 186 ATMs across the country. The Bank serves over 1.7 million customers, which is a quarter of the total banking population in Uganda. Its mission is “To provide appropriate financial services, especially microfinance to all people, in a sustainable manner and in accordance with the law.”.