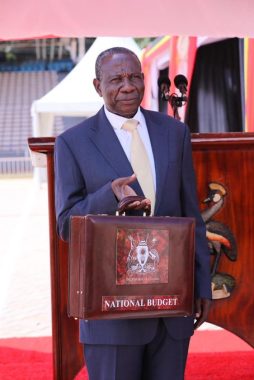

Uganda’s total public debt is projected to rise to USD 31.5 billion (Shs 116 trillion) by the end of June 2025, according to the Minister of Finance, Planning and Economic Development Matia Kasaija. The revelation came as he presented the Shs 72 trillion national budget for the financial year 2025/2026 to Parliament on Thursday.

Of the projected public debt stock, external debt will constitute USD 15.49 billion (Shs 56.3 trillion), while domestic debt will stand at USD 16 billion (Shs 59.77 trillion). This places Uganda’s debt-to-GDP ratio at 51.26%, a level the Minister said remains “consistent with the Charter of Fiscal Responsibility.”

“Uganda’s debt is sustainable and is projected to remain so in the medium to long term,” he noted, adding that the borrowing has supported significant infrastructure investments aimed at boosting private sector productivity.

The Minister detailed that over the last decade, public debt has financed: Transport infrastructure (29.3%), Electricity infrastructure (27.6%), Water for production and consumption (11.5%), Agro-industrialisation (5.1%), Education and health (5%), Housing and urban development (3%) and Industrial park development (2%).

To sustain debt stability, Government will scale up domestic revenue mobilisation, seek concessional loans from development partners, and roll out the Okusevinga initiative, which will allow Ugandans to invest in government securities via mobile money.

Government plans to collect Shs 37.2 trillion in domestic revenue next financial year 2025/26. This will finance about 60 percent of the national budget. The rest of the budget will be financed through borrowing and grants.

He explained that government expects to raise UGX 37.55 trillion in domestic revenue, including UGX 33.94 trillion from taxes, UGX 3.28 trillion from non-tax sources, and UGX 328.6 billion from local government collections. The budget will also be financed through UGX 11.38 trillion in domestic borrowing, UGX 10.03 trillion for refinancing maturing domestic debt, UGX 2.08 trillion from general budget support in external grants and borrowing, and UGX 11.33 trillion in external financing for projects, of which UGX 2.8 trillion is in form of grants.

The Minister stated that the fiscal strategy for FY2025/26 is anchored on strengthening tax compliance, eliminating inefficient tax waivers, and improving the effectiveness of Uganda Revenue Authority. He said the government has adopted a multifaceted financing plan that includes enhancing tax administration to generate an additional UGX 1.89 trillion, introducing new tax policy measures expected to raise UGX 538.6 billion, and rationalising tax exemptions that are not aligned with Uganda’s industrial priorities.

In his closing remarks, the Minister said the economy is “taking off,” revealing improvements in GDP growth, currency stability, job creation, and Uganda’s progress toward graduating from Least Developed Country (LDC) status.

“This budget is for all Ugandans who are ready to create wealth,” he said while dedicating it especially to the youth, women, and private sector players.

The Minister also reassured stakeholders about allocations to elections, social safety nets, creative industries, sports, and the security sector, concluding with a rallying call: “I dedicate this budget to all the wealth creators, particularly the youth and women.”