The ministry of finance and economic planning did not do their home work with the presentation they put before Parliament.

May be they were overwhelmed by the an unexpected Covid-19 and the pressure it has exerted on the economy.

How do you impose additions on fuel when the country needs production? Fuel companies must be struggling with sales with transport industry asked to sit down.

Even they were projecting after Covid-19! You do not want to hurt movement of people by increasing tax on fuel and expect operators to keep the fares down.

The Committee on Finance practically throw out the proposals by the ministry of finance and economic planning.

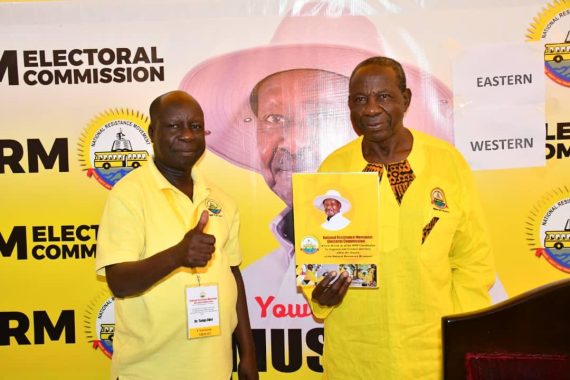

The committee chief Henry Musasizi1 rejected the increase in excise duty on petrol, diesel and kerosene respectively.

Musasizi said: “Government had proposed an increase of shs150 for petrol and diesel respectively and shs100 on kerosene.”

He argued: “Considering the current situation couched by #COVID19UG, where the whole country is on lock down with all major production sectors of the economy closed, the current excise duty rates should be maintained so as to stimulate the economy and enable it to recover.”

Musasizi added: “Given the certainty of a ripple effect of an increase in fuel costs on other sectors of the economy, the proposed increase of Excise Duty under cigarettes, beer, spirits, wine, non alcoholic beverages, fuel, Lubricants, motorcycles registration be dropped.”

The Committee recommended that the current excise duty on malt beer, beer from local raw materials and soft drinks and juices should be maintained.

Musasizi noted: “Government had proposed increase in excise duty on these drinks.”

He explained: “The bill seeks to increase the Excise Duty on soft cap cigarettes from shs55,000 to UGX 75,000 per 1000 sticks and on hinge lid cigarettes from shs 80,000 to shs120,000 per 1000 sticks.”

He went on: “This may force manufacturers to lower the price of tobacco from the farmers. This will also affect the operations of tobacco factories as the economy recovers from Covid-19 pandemic. The current rates on cigarettes should be maintained to enable recovery of the sector.”

The House considered the Excise Duty (Amendment)Bill, 2020 and to amendment the Excise Duty Act,2014 to vary excise duty in respect of excisable goods.

Award winning journalist and writer who has worked as a stringer for a couple of acclaimed South Africa based German journalists, covered 3 Ugandan elections, 2008 Kenya election crisis, with interests in business and sports reporting.