Ugandans have been advised to take advantage of savings and loans to achieve their aspirations.

The call was made during a financial and digital inclusion webinar organized by Airtel Uganda on Thursday 1stJuly,2021 under the theme; Transforming Lives Through Digital Microfinance: Savings and Loans, at the second Airtel Uganda webinar held on July 1st, 2021.

Attended by industry experts, the webinar underscored the importance of technology and mindset if we are to deepen financial inclusion in Uganda.

“Whether you are going to borrow money or you are going to accumulate your savings and then invest it later, it all begins with savings. All we need to teach our people is to understand technology so that they get used to interacting with gadgets and change their mindset towards saving,” Mr Joseph Lutwama, Director Programs, Financial Sector Deepening –Uganda said.

“Savings is just a starting point, it can never be enough to finance business, you need credit as well to achieve your desired goals.”

According to statistics from Finacial Sector Deepening Uganda, only 5% of people in Uganda take loans from banks because of fear associated with failure to pay on time.

To revolutionise and deepen the loans and savings culture in Uganda, experts have re-emphasised the role of innovation and synergies.

To realise this, Airtel Uganda in partnership with KCB Bank Uganda recently introduced Airtel Money SuperSaver, a mobile-based savings product, and the Agent Float Financing, a credit facility for Airtel Money agents.

“We wanted to make it easy for our customer to access credit for their businesses or other demands but also help them save some money with convenience. We strongly believe it’s through such products that we can deepen financial inclusion by extending reliable, safe and secure financial services to people who find it difficult or inconveniencing to access a bank,” Mr. Amit Kapur, the Chief Commercial Officer at Airtel Uganda said.

Commenting about the same, Mr. Edgar Byamah, Managing Director KCB Uganda, said; “Diversifying savings, partnerships across different sector players including insurance, banks among others should be a major growth aspect which should be fronted. The Banks need to leverage more on partnerships to drive innovation.”

Dissecting the savings culture in Uganda, the experts highlighted the importance of trust and access to financial services.

“One needs to leverage their savings; a bank will not give you money unless they are sure that you have sufficient cash flows for you to be able to service the debt,” Mr Lutwama advised.

Commneting on access, Mr. Amit said; “With over 10 milion subscribers all over the country many of whom do not have bank accounts, Airtel has positioned itself as the bank to the unbanked enabling Ugandans to easily save and access loans right at the comfort of their homes and with no traditional collateral security.”

Bankers as well, have been deliberate on easing access to banking services and are doing a lot more to diversify savings while ensuring there is continued trust with customers.

“Banks have been adjusting to the reality fast, to increase their reach. Now they are targeting financial inclusion as one of the key aspects in the industry. In terms of innovation, digital offering banks have to slowly invest in integration aimed at supporting commerce, payments and savings.” “Depositors continue accessing their money whenever they want it and that is due to the trust and confidentiality that we have built overtime,” Mr. Byama said.

In conclusion, Dr. Fred Muhumuza, The Development Policy Analyst & Lecturer at Makerere School of Economics, cited need by Ugandans to consider credit backed by savings for any business to thrive.

“Money is the major transformer of the economies, it’s the blood of the economy, without credit, you can’t develop the economy. The partnerships between banks and the telecoms are really a welcome gesture which will in a long run leave a huge land mark on the economy.”

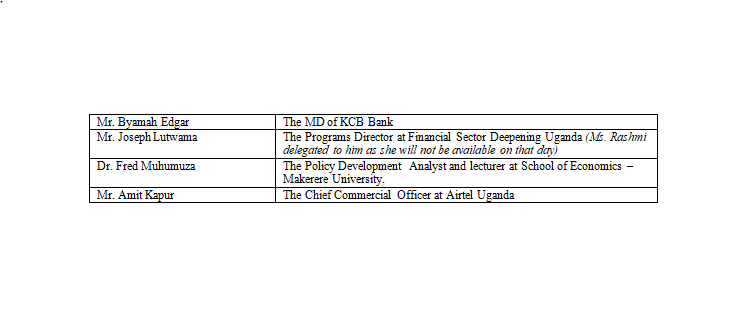

Panelists at the webinar included;